The Organizational Lie: Why Companies Devalue Their Customers

If customers fuel our growth, then why do we subscribe to countless decisions and systems that support the Organizational Lie?

The Core Problem

We have a crisis with leadership intent. We claim we value customer relationships, but our operational investment reveals that we value only the customer's transaction. There exists a systemic dishonesty between what we say we value versus the outcomes of the systems, models and decisions we implement daily.

How We De-Value the Customer: The Three Biggest Lies

The Three Biggest Lies We Tell Ourselves

Each "lie" represents a structural and leadership flaw that erodes customer equity and disguises extraction as growth.

| Organizational Lie | What It Looks Like | How It Damages Customer Equity | Better Path Forward | |-------------------|-------------------|-------------------------------|-------------------| | We sell for today's figure, not for long-term health | Sales teams prioritize short-term quota and acquisition wins while ignoring long-term relationship health | Creates churn, weakens trust, and reduces Customer Lifetime Value (CLV) | Shift incentives toward renewals, expansions, and multi-year relationship outcomes | | Automation replaces, rather than enhances, human connection | AI and efficiency metrics (AHT, CPC) dominate service design, rewarding speed over empathy | Turns service into a cost center instead of a loyalty driver, degrading relationship repair moments | Use AI to augment human empathy — automate routine tasks, not relationships | | Short-term ROI rules over strategic value creation | Leadership measures performance by immediate financial returns, not by customer impact or retention | Starves long-term growth investments and signals that relationships are expendable | Adopt Customer Equity metrics that link CX investments to enterprise value |

We Sell for Today's Figure, Not for Long-Term Health

This is the first lie: We fund acquisition, but we fear retention. When we define success simply as "deal closed," we reduce our customer perspective to extracted value rather than a relationship to nurture.

Automating the Customer Experience is Good, Until You've Removed the Human Relationship

This is the second lie: We claim we're the customer's champion, but we process as cheaply as possible. Metrics such as Average Handle Time (AHT), Cost Per Contact (CPC), and Deflection Rate explicitly reward moving the customer out of your system quickly and cheaply.

Long-Term Health is Ruled by Short-Term ROI

This is the third lie: We spend a lot of time long-term planning, but define success by the "right now." By treating customer retention as a cost center, the C-Suite systematically undervalues the most crucial asset: Customer Lifetime Value (CLV).

Rebalancing the Balance Sheet: 3 Benefits of the Customer Equity Model

If you truly intend to drive your organization's growth, you must commit to making a quantifiable difference in the lives of your customers. Correcting the structural flaws shifts the focus from cost extraction to Customer Equity.

Problem Solvers are the Catalyst for Building Relationships

When support agents and account managers shift from being "problem processors" to "problem solvers," they become "relationship builders." Empowering your front line to resolve the customer's underlying need becomes your ultimate, quantifiable anti-churn mechanism.

When 'What Else' and 'What's Next' Unlocks Adjacency

Removing the pressures created by transactional process metrics frees your teams to adopt a more proactive intelligence-gathering approach. This is where asking the insightful questions of "What else?" and "What's Next?" uncovers your customer's true needs.

Technology & AI: Fueling the Enhanced Human Relationship

The third strategic benefit is the ability to leverage technology and AI, not to replace the human relationship, but to fuel it. Technology and AI are mandated to handle the low-touch, repetitive tasks and augment the high-touch, customer interactions where speed and empathy must both exist.

The Leader's Fork: Are You Designed for Transaction or for Customer Equity?

The Organizational Lie is not a failure of individual effort but a failure of leadership intent. When your operations are optimized for transaction speed and cost minimization, they are by definition designed to devalue the relationship.

As a leader, you stand at a critical fork. You can decide to carry on and continue to extract short-term profits, or you can commit to building Customer Equity that guarantees long-term growth.

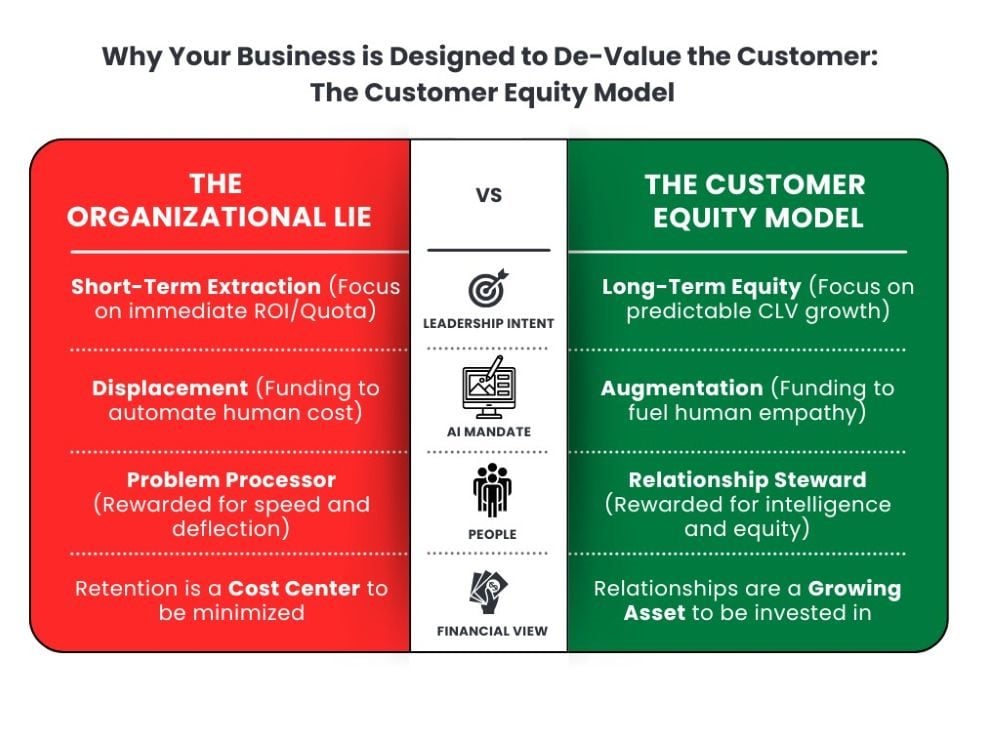

The Organizational Lie vs. The Customer Equity Model illustrates the critical shift in leadership intent required to transition from short-term cost extraction to a strategy focused on long-term, predictable growth.

The Customer Equity Model — The Choice Is Yours

The Organizational Lie is that we can achieve long-term growth by continually extracting from the short-term. The market uncertainty you face, the rising prices you charge, and the competitive threats you track are not the causes of your instability; they are the symptoms of a failure of intent.

The path to predictable, sustainable, long-term customer growth is achievable, but it requires a decisive shift. You must decide to genuinely put your customer first: to continually seek ways to solve their problems and drive your entire organization with intent toward lasting value.

Comments

Join Our Community

Sign up to share your thoughts, engage with others, and become part of our growing community.

No comments yet

Be the first to share your thoughts and start the conversation!